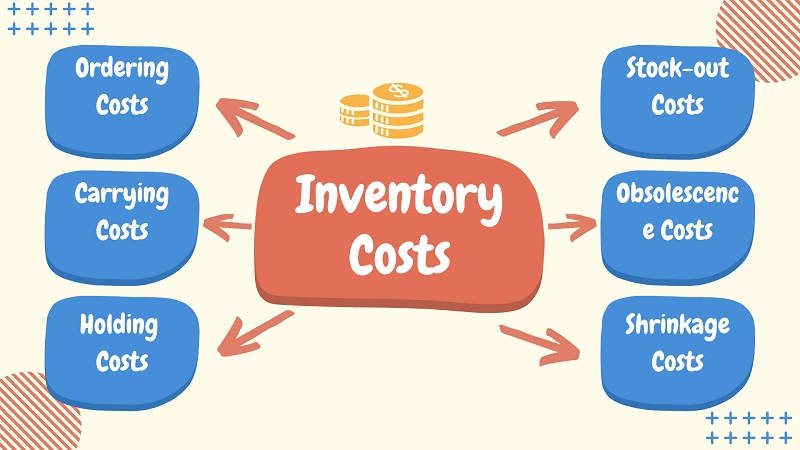

Since inventory costing techniques affect both overall profitability and the cost of goods sold (COGS), they are essential for companies that manage stock. The Weighted Average Cost approach, Last-In, First-Out (LIFO), and First-In, First-Out (FIFO) are some of the most often utilized techniques. Because each of these methods assigns expenses in a different way, there may be notable differences in a company’s pricing strategy, tax liabilities, and financial performance. This article explores how various strategies might affect a company’s financial performance.

First-In, First-Out (FIFO)

The oldest inventory products are supposed to be sold first according to the FIFO approach. Because it lowers COGS and, as a consequence, increases profitability, this approach is particularly advantageous during periods of increasing pricing. Businesses may also avoid exaggerated inventory carrying costs by employing earlier expenses, which will result in more favorable financial results. Furthermore, this method offers a more realistic depiction of the state of the market, which is essential for pricing strategies. Businesses must exercise caution, however, since increased earnings may result in increased tax obligations. For inventory costing methods it works fine.

Last-In, First-Out (LIFO)

The LIFO strategy, on the other hand, suggests that the inventory that has been obtained most recently is sold first. This strategy may result in increased COGS during inflationary times because it makes use of the newest, often more costly inventory. As a result, companies could declare reduced earnings, which might be beneficial in terms of taxes. LIFO, however, may also result in out-of-date inventory values on the balance sheet, which might deceive stakeholders about the true state of the company’s finances. Businesses thinking about LIFO must thus assess both the immediate benefits and the long-term effects on their financial narrative.

The Weighted Average Cost Approach

By averaging all inventory prices, the Weighted Average Cost approach reduces the influence of price volatility and produces a steady COGS. This method is simple and may simplify financial reporting for low-value, high-volume inventory. It may, however, mask the true cost dynamics that the company faces, even if it might provide more stable profit margins. Additionally, shifting market circumstances may reduce this method’s capacity to accurately portray genuine profitability, thus businesses must constantly reassess its suitability.

Effect on Profit Margin and Pricing Strategies

Pricing strategies and profit margins may be greatly impacted by the inventory costing approach that is used. Setting competitive pricing requires precise cost allocation. In a rapidly increasing inflationary climate, for example, companies who use FIFO may discover that their pricing reflects reduced expenses, giving them an edge in competitive pricing. On the other hand, a business that uses LIFO may have to modify its pricing strategy to reflect increased COGS, which, if poorly handled, might result in a smaller market share. In the end, knowing the ramifications of these techniques may help direct company choices and increase profitability.